At Kama Capital

High Frequency Trading (HFT) is a game-changer for traders who seek to capitalize on market opportunities in a fraction of a second. Using sophisticated algorithms and lightning-fast execution, HFT allows traders to react to market fluctuations and execute thousands of trades within milliseconds. Whether you're a seasoned professional or exploring the world of trading, HFT can enhance your portfolio and empower you to stay ahead of market trends.

Key Benefits of High Frequency Trading

Unparalleled Speed

HFT algorithms can execute trades within milliseconds, allowing you to capture market inefficiencies before they disappear. In a market where time is money, speed is the ultimate advantage.

Precise Market Execution

With High Frequency Trading, precision matters. Algorithms are designed to take advantage of even the smallest price discrepancies, ensuring that trades are executed with pinpoint accuracy.

Enhanced Liquidity

HFT plays a crucial role in improving market liquidity, providing tighter spreads and greater opportunities for traders to enter and exit positions quickly and efficiently.

Automated Strategies

Harness the power of automation with algorithms that respond to market changes without human intervention. HFT strategies are continually optimized to ensure the most profitable outcomes.

Why Choose Our High Frequency Trading Platform?

Advanced Algorithms

Our platform uses cutting-edge algorithms designed by industry experts to maximize profit potential and minimize risks.

Ultra-Low Latency

We prioritize speed with our ultra-low latency infrastructure, ensuring trades are executed with minimal delay.

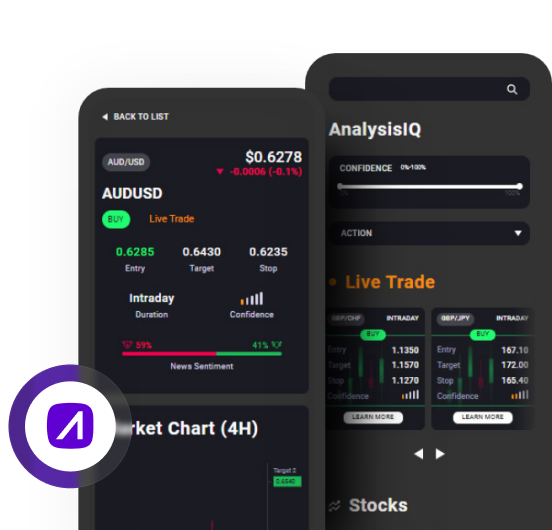

Comprehensive Analytics

Gain insights from real-time data analytics that help you make informed decisions and optimize your HFT strategies.

Security and Reliability

Your assets and data are safe with us. Our platform is built with state-of-the-art security features to ensure the highest level of protection.

Seamless execution at

lightning speed

How High Frequency Trading Works

01

Market Scanning Capabilities

Our platform enables your algorithms to seamlessly scan global financial markets, empowering them to identify pricing inefficiencies, volatility, and liquidity opportunities across multiple asset classes.

03

Execution Infrastructure

Leveraging our ultra-low latency infrastructure, your algorithms can execute trades across various markets at high speeds, capturing price movements and maximizing profitability within milliseconds.

04

Post-Trade Analysis Support

With our analytics tools, you gain insights into trading performance, enabling you to fine-tune and adjust your strategies. Review trade outcomes, assess market trends, and optimize future executions all within one comprehensive platform.

FAQs

HFT is a form of algorithmic trading that uses powerful computers to execute trades at very high speeds, often within microseconds or milliseconds.

HFT is ideal for traders looking to take advantage of small price fluctuations in the market. It's especially useful for institutions or experienced traders who can leverage sophisticated technology to optimize their trades.

HFT strategies can range from arbitrage, market-making, and trend-following strategies. Our platform allows for customization and optimization of strategies based on market conditions.

Ready to Accelerate Your Trading Journey?

Sign up for a demo today and experience the speed and precision of High Frequency Trading firsthand. Discover how milliseconds can make all the difference.